Aramid fiber is a high-performance synthetic fiber known for its exceptional strength, durability, and heat resistance. These fibers play a critical role in diverse industries such as aerospace, defense, automotive, sports equipment, and protective clothing. Their unique chemical structure and physical properties make them an indispensable material for applications requiring lightweight yet robust materials with excellent fatigue resistance. The global aramid fiber market is currently experiencing strong growth, driven primarily by increasing demand for advanced protective gear, lightweight composites, and industrial applications.

Market Overview and Growth Dynamics

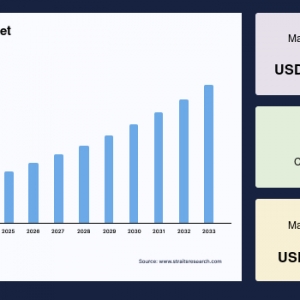

The global aramid fiber market size was valued at USD 4.59 billion in 2024. It is projected to reach from USD 5.01 billion in 2025 to USD 10.21 billion by 2033, growing at a CAGR of 9.30% during the forecast period (2025–2033).

This growth is propelled by rising investments in sectors such as aerospace, defense, automotive, and industrial manufacturing, where the demand for lightweight, high-strength materials is surging. Furthermore, stricter environmental regulations aimed at reducing vehicle emissions have catalyzed the substitution of heavier materials like steel and aluminum with lighter aramid fibers, promoting fuel efficiency and reducing carbon footprints.

Key Properties and Applications

Aramid fibers belong to the aromatic polyamide family and demonstrate roughly a 20-fold higher elastic modulus than conventional polyamide fibers. Their chain-like molecular structure aligned along the fiber axis results in stronger chemical bonds, lending the fibers superior resistance to heat, organic solvents, and mechanical fatigue. Though they have relatively low radial strength due to weak hydrogen bonding, their axial load capacity remains unaffected by hydrogen bond breakage. These properties make aramid fibers ideal for reinforcing composites in applications such as ballistic body armor, aerospace components, automotive heat shields, fire-resistant clothing, and industrial filtration systems.

One notable segment driving market growth is para-aramid fiber, highly favored for its tensile strength and durability. It finds extensive use in defense and automotive industries, from ballistic protection vests to tire reinforcement and brake pads. The thermal stability and abrasion resistance of aramid fibers also make them suitable for friction materials and electrical insulation. Due to their flame-retardant properties, these fibers offer exceptional protection for firefighters and military personnel by providing critical time and mobility in hazardous environments.

Regional Market Insights

Europe currently stands as the largest market for aramid fiber, led by countries such as Germany, France, and the United Kingdom. Stringent safety regulations in sectors like oil and gas, automotive, aerospace, and construction have fueled the adoption of aramid fibers for protective apparel and industrial parts. The demand for friction materials in luxury and industrial vehicles further drives adoption in this region.

Asia Pacific emerges as the fastest growing market, propelled by rapid industrialization, infrastructure development, and expanding telecommunications. Major countries like China, India, Japan, and Australia are witnessing increasing security and safety standards that boost the demand for aramid fiber in automotive thermal insulation, protective clothing, optics, and filtration. Competitive manufacturing costs and significant government initiatives supporting industrial safety accelerate growth prospects in this region.

Market Challenges and Opportunities

Despite the favorable outlook, the aramid fiber market faces certain constraints. These fibers are vulnerable to moisture absorption in wet environments and can degrade under UV exposure, necessitating specialized coatings that increase production costs. Additionally, the high expenditure associated with research and development limits entry for smaller players. The non-biodegradable nature of aramid fibers also raises environmental concerns over disposal and sustainability.

Nevertheless, advancing manufacturing technologies offer potential for enhanced product quality and broader applications. Ongoing innovations to develop lightweight armor and improved personal protective equipment will continue to expand market opportunities. Moreover, increasing defense budgets and growing awareness of occupational safety in emerging economies present lucrative avenues for market expansion.

Industry Applications and Market Segmentation

The automotive sector is one of the top contributors to aramid fiber demand, utilizing it for reinforcement in tires, turbocharger hoses, powertrain components, belts, brake pads, gaskets, clutches, seat fabrics, electronics, and hybrid motor materials. The shift towards lightweight vehicles employing aramid composites supports increased fuel efficiency and reduced emissions. In addition, motor racing increasingly favors aramid fiber composites over fiberglass due to better impact resistance and safety benefits.

Security and protection applications dominate the market, where aramid fibers are used in protective gloves, helmets, body armor, and fire-resistant suits. The thermal stability of the fiber allows it to form a protective barrier in flashover heat conditions without compromising flexibility.

Industrial filtration, frictional materials, and rubber reinforcement are other significant application areas benefiting from the fiber's chemical resistance and wear properties. The demand for optical fibers and electrical insulation also contributes to steady market growth.

Key Market Players

The aramid fiber industry is characterized by the presence of several established companies holding significant market shares. Leading players include DuPont de Nemours, Inc., Teijin Limited, Kolon Industries, Toray Industries, Kermel, Hyosung Corporation, and China National Bluestar, among others. These companies are investing heavily in research and development to enhance fiber quality, expand production capacity, and diversify application areas. Strategic focus on expanding regional footprints, especially in Asia Pacific, also forms a critical component of their growth strategies.

Conclusion

The global aramid fiber market is poised for strong growth fueled by rising demand across automotive, aerospace, defense, and industrial sectors. Aramid fibers’ unique properties such as high tensile strength, thermal stability, chemical resistance, and lightweight nature position them as vital materials for future innovations in protective gear, composites, and filtration products. While challenges related to cost, environmental impact, and technical limitations exist, advancements in material science and expanding applications offer promising opportunities. The increasing emphasis on safety, sustainability, and fuel efficiency will continue to drive the aramid fiber industry’s evolution over the coming decade.